SIMON PROPERTY GROUP (SPG)·Q4 2025 Earnings Summary

Simon Property Delivers Record FFO, Completes Taubman Acquisition

February 2, 2026 · by Fintool AI Agent

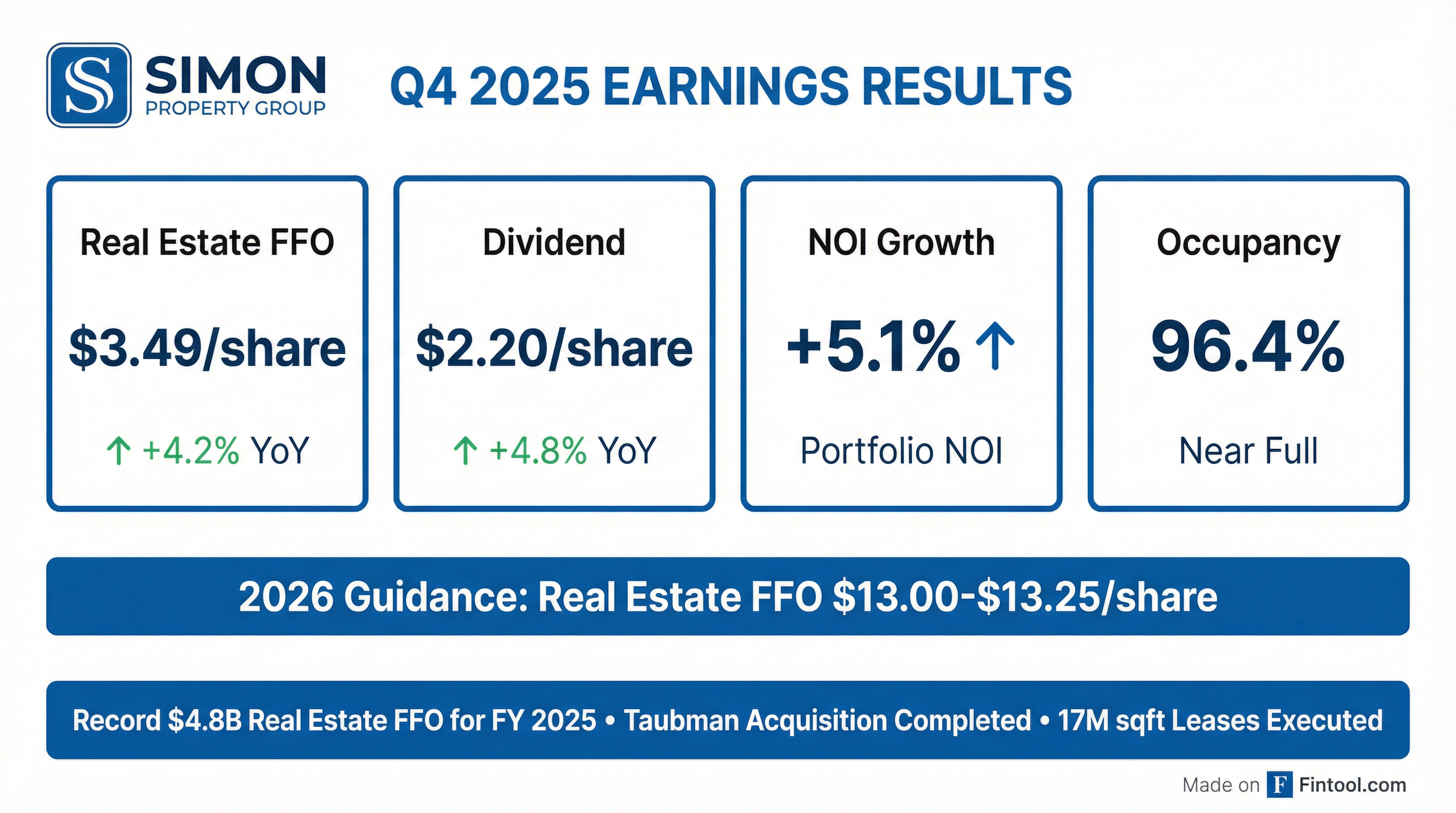

Simon Property Group closed out 2025 with a strong fourth quarter, reporting Real Estate FFO of $3.49/share (+4.2% YoY) and capping a record year with $4.8 billion in Real Estate FFO. The REIT giant completed its acquisition of the remaining Taubman Realty Group stake, returned $3.5 billion to shareholders, and raised its quarterly dividend 4.8% to $2.20/share.

Did Simon Property Beat Earnings?

Simon delivered a mixed quarter relative to traditional metrics, but the key REIT performance measures showed solid momentum:

The headline: Real Estate FFO—the cleaner measure for REITs that excludes non-core items—beat prior year handily at $3.49 vs $3.35.

The noise: Net income soared to $9.35/share but that includes a $2.89 billion non-cash gain from the Taubman acquisition (remeasurement of previously held equity to fair value). Meanwhile, reported FFO of $3.27/share declined due to $120.7 million in Catalyst Brands restructuring costs and valuation adjustments.

What Did Management Guide?

Simon issued 2026 guidance of $13.00-$13.25 per share for Real Estate FFO, implying 2.1% to 4.1% growth from FY 2025's $12.73.

The guidance implies continued steady FFO growth, supported by:

- Strong leasing momentum (17 million sqft executed in 2025)

- Taubman properties now fully consolidated

- Rent spreads trending positive (+4.7% base minimum rent PSF)

Full Year 2025: A Record Year

CEO David Simon highlighted the company's record performance: "In 2025, we generated record Real Estate Funds From Operations of $4.8 billion and returned a remarkable $3.5 billion to our shareholders."

What Changed From Last Quarter?

The Taubman Deal Closed: On October 31, 2025, Simon acquired the remaining interest in Taubman Realty Group, bringing 16 additional premier malls fully onto Simon's books. This resulted in a $2.89B non-cash accounting gain and significantly expanded the portfolio.

Portfolio Scale: The company now owns or has interest in 254 properties comprising 206 million square feet across North America, Asia, and Europe—plus a 22.2% stake in European REIT Klépierre.

Operating Stats Remain Strong:

Retailer sales productivity jumped 8.1% to $799/sqft—a strong indicator of tenant health and Simon's ability to push rents.

How Did the Stock React?

SPG traded essentially flat on earnings day, closing at $191.22 (-0.4%) but dipping to $188.95 in after-hours trading (-1.2% from close). The muted reaction suggests the results were largely in-line with expectations.

Context: The stock is trading near its 52-week high of $193.48, up substantially from the 52-week low of $136.34. Year-to-date, SPG has been one of the better-performing REITs as investors seek yield and bet on retail resilience.

Capital Allocation & Balance Sheet

Simon maintained its fortress balance sheet while aggressively returning capital:

Liquidity: $9.1 billion available ($1.4B cash + $7.7B revolving credit capacity)

Capital Markets Activity in 2025:

- $1.5B senior notes (7.8-year weighted average, 4.775% coupon)

- 46 secured loan transactions totaling $7.0B (5.43% weighted average rate)

- Post-quarter: $800M 5-year notes at 4.30% to refinance maturing debt

Credit Profile:

Dividend: The board raised the quarterly dividend to $2.20/share (+4.8% YoY), payable March 31, 2026 to shareholders of record March 10, 2026. This marks continued dividend growth as the company balances returns with reinvestment.

Tenant & Leasing Dynamics

Simon's top tenants remain diversified, with no single inline tenant exceeding 2.6% of base rent:

Anchor exposure is meaningful but rents are minimal—Macy's occupies 11.7% of square footage but pays only 0.3% of rent.

Lease Expirations: Only 8.7% of gross rental revenue expires in 2026, with expiring base rent PSF at $55.63—below the portfolio average of $60.97, suggesting positive renewal spreads ahead.

Q&A Highlights: Tariffs, Tenant Credit, and Saks Strategy

The earnings call Q&A revealed management's thinking on several key topics:

Tariff Impact on Retailers

CEO David Simon was blunt about tariff headwinds: "The tariffs are clearly having an effect on retailers... it's gonna take $200 million of EBITDA away from Catalyst to pay the government."

He noted the full impact will materialize in 2026: "Retailers dealt with it successfully this year, but the full impact will really be 2026, because it was implemented in April." The company referenced Polymarket odds of 25-32% for tariff policy surviving Supreme Court review.

Saks/OFF 5TH Replacement Strategy

On replacing Saks OFF 5TH boxes, Simon outlined compelling economics: "Saks OFF 5TH total was paying us around $18 million. We think half the portfolio will pay us $30 million, and then we have the other boxes that we'll generate."

Regarding the $100M Saks Global investment, Simon confirmed they wrote it off but received valuable consideration: rights to terminate 2 leases, 2 buildings, REA amendment rights across the entire Saks/Neiman portfolio, and upside participation in Authentic Brands' IP holding company.

Leasing Pipeline Strength

CFO Brian McDade and Eli Simon highlighted accelerating demand:

- Leasing pipeline up 15% YoY on a like-for-like basis

- New lease rents averaging ~$65 PSF, expected to continue

- 30% of 2025 volume was new deals (not renewals)

- Signed & Not Opened (S&O) at 2.1% at year-end, consistent with prior years

Class B Properties Improving

On the quality mix, David Simon noted: "It is getting easier to lease Class B versus 12 months ago." He cited Southdale Center as an example of transforming a "C asset" into an "A asset" through strategic leasing of 70,000 sqft of high-end tenants.

Luxury Tenant Outlook

On luxury demand, Simon described it as "steady as she goes": "Some growing, some peeling the onion, and a lot of them stable. The great thing about these brands is they make long-term decisions." He noted potential upside if luxury brands reduce wholesale through Saks/Neiman.

Simon Plus Loyalty Program

Eli Simon provided an early read on the November-launched loyalty program: "We've been very pleased with the adoption from both a customer perspective, but also getting brands excited about it... we had a great holiday activation that got a lot of organic buzz."

2026 Guidance: Key Assumptions

Management provided additional color on the 2026 outlook:

David Simon on guidance philosophy: "We start the beginning of the year very conservatively and build throughout the year... if we get 3% sales growth, I would hope to beat our estimates."

Risk Factors to Watch

Management flagged several risks in the forward-looking statements:

- E-commerce competition and the ongoing shift in retail spending

- Tariff and trade policy impacts on tenant supply chains—CFO noted unexpected bankruptcies at Saks and Eddie Bauer surfaced early 2026

- Interest rate sensitivity given the $35.4B debt stack (though 97% is fixed-rate)

- Tenant bankruptcies and department store restructurings

- Catalyst Brands exposure (restructuring costs hit Q4)

- Geographic pockets of weakness—Simon noted Canadian border traffic "really weak" and some sales disruption in markets with ICE enforcement activity

The Bottom Line

Simon Property delivered exactly what investors expect from the dominant mall REIT: steady FFO growth, disciplined capital allocation, and a growing dividend. The Taubman acquisition adds 16 premier properties to an already fortress-like portfolio. While traditional metrics were noisy due to the acquisition and Catalyst restructuring, the underlying Real Estate FFO trajectory remains healthy at +4% growth.

The earnings call revealed a nuanced picture: leasing fundamentals remain strong (pipeline up 15%, new rents at $65 PSF), but tariff headwinds and retailer stress are real concerns. Management's candid acknowledgment that "tariffs are clearly having an effect on retailers" and their conservative posture on tenant credit suggests 2026 won't be all smooth sailing.

The Saks strategy is telling—Simon's ability to replace OFF 5TH at nearly double the rent ($18M → $30M for half the portfolio) demonstrates the pricing power of Class A retail real estate. Meanwhile, the $4B+ redevelopment pipeline positions the company for sustained growth beyond 2026.

2026 guidance of $13.00-$13.25 FFO implies continued low-single-digit growth—not exciting, but consistent. With shares near 52-week highs and a ~4.6% dividend yield, SPG remains the blue-chip choice for retail REIT exposure.

Data sources: Simon Property Group Q4 2025 Earnings Release, 8-K Filing dated February 2, 2026, S&P Global